RAYYAN AOUN

Operational Due Diligence

Multi-Management

Globally recognized as a leading investor in Emerging Manager investing 1, NewAlpha sources, analyses, selects and supports innovative investment funds offered by independent investment managers.

NewAlpha offers its institutional clients a wide range of customized investment solutions and services in alternative and traditional asset classes: Hedge Funds, Private Debt and Public Equity.

Leveraging its experience in detecting high-potential entrepreneurial projects, New Alpha has enabled professional investors to benefit from the growth and strategic innovation of the European Fintech sector through its Venture Capital funds since 2015.

Regulated by the Autorité des Marchés Financiers (AMF), NewAlpha Asset Management is a subsidiary of La Française AM (Crédit Mutuel Alliance Fédérale group).

1Present in the Top 5 Seeding ranking published by HFM Week continuously from 2012 to 2018

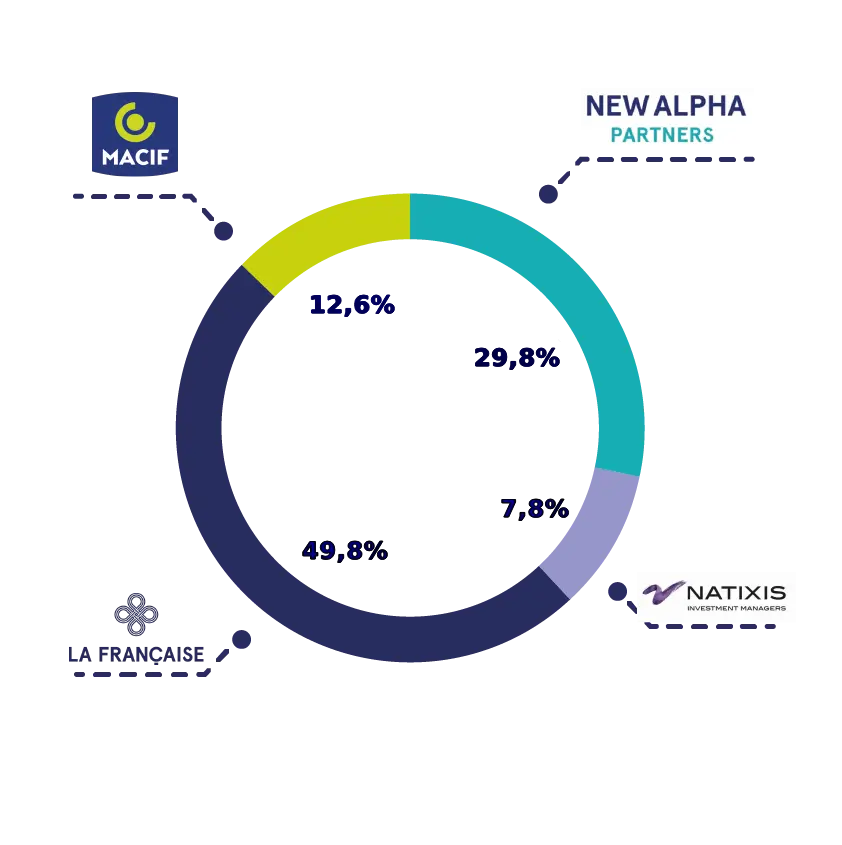

NewAlpha Asset Management is supported by three leading institutions active in asset management, insurance and banking: La Française Group, Macif and Natixis Investment Managers. The employees associated with NewAlpha Partners make a long-term commitment, aligning their interests with those of the investors.

Shareholder structure as of end December 2021

Since its creation, NewAlpha has invested regularly to strengthen, improve and organize its resources in the most efficient way possible. NewAlpha differentiates by its team, its technology and its processes.

Team

A team of 28 employees with an average

Professional experience of 21 years

17 professionals dedicated to investment

Alignment of interests with those of the company and its clients

Technology

A suite of scalable analytical tools, specially designed for NewAlpha

On average, 5% of revenues invested in technology every year

A design geared towards productivity and teamwork

Progress

A clearly defined process, sequenced in separate stages

Rigorous execution, documented and applied to all of the company's business lines

NewAlpha has been a signatory to the United Nations’ Principles for Responsible Investment (PRI) since 2017.

This commitment underlines the importance we attach to long-term growth, sharing of value creation in a framework defined by best-in-class governance and transparency.

As a signatory of Principles for Responsible Investment, NewAlpha makes the following six commitments:

More information on the Principles for Responsible Investment on the website www.unpri.org

Aware of its role and responsibility as a responsible investor, NewAlpha has integrated many ESG (Environmental, Social and Governance) criteria into its investment activities. NewAlpha is convinced that these criteria contribute durably to the creation of value for the benefit of investors.

Its organization

Its investment management policy, in particular investment and divestment in the equity of SMEs

The CSR (Corporate Social Responsibility) policy of the companies in the Venture Capital funds' portfolio

The internal ESG policy aims to:

Operational Due Diligence

Multi-Management

Chief Operating Officer

Multi-Asset Investment

Head of Quantitative Research

Multi-Asset Investment

Senior Advisor

Manager Research

Multi-Asset Investment

Managing Partner

Venture Capital

Portfolio Manager

Multi-Asset Investment

Head of ESG - Manager Research

Multi-Asset Investment

Investment Director

Venture Capital

Operations Manager

Operations

Co-Chief Investment Officer

Multi-Asset Investment

Investment Director

Venture Capital

Head of Business Development

Business Development

Operational Risk Analyst

Managing Partner

Business Development

Manager Research

Multi-Asset Investment

Fund Analyst

Multi-Asset Investment

Chief Executive Officer, Co-Chief Investment Officer

ESG Analysis

Multigestion

Financial Controller

Operations

Manager Research

Multi-Asset Investment

Portfolio Management

Multi-Asset Investment

Operations Analyst

Multi-Asset Investment