BENOIT DONNEN

Head of ESG - Manager Research

Multi-Asset Investment

NewAlpha’s commitments emphasize the importance of long-term growth, sharing value creation and pursuing the necessary transitions associated with climate change and the social challenges it entails.

Whether in the development of its business or within the company itself, NewAlpha is committed to working with its employees and clients to meet today’s environmental and social challenges.

The corporate social responsibility policy of Group La Française includes the specific approach of NewAlpha.

NewAlpha and its employees benefit from the actions taken by its main shareholder on environmental, social and governance issues. To learn more about the commitments made by Group La Française.

Internally, CSR is a concrete approach to involving employees at the heart of NewAlpha’s governance. As a responsible and committed employer, NewAlpha makes every effort to offer its employees a pleasant, efficient and motivating working environment, both professionally and personally.

Thanks to a dedicated support structure, NewAlpha Capital Partners, we develop a privileged relationship with our affiliates. This relationship goes far beyond basic and traditional financial monitoring and participation in governance bodies.

NewAlpha is convinced that ESG criteria are sustainable levers of value creation that contribute to the transformation of SMEs into SMIs. As part of a process of progress in terms of social responsibility, our objective is to make our investments profitable and sustainable to support the transition to more responsible finance over the long term.

NewAlpha has supported the Espérance Banlieues association since 2020. This sponsorship and mentoring enable NewAlpha employees to devote time to the development of alternative education in precarious suburbs. In 2021, NewAlpha has strengthened its commitment to this association with a financial donation to support a third-grade class for the year 2021-2022. This donation is also accompanied by a commitment by employees to the students through quality exchange time and academic support. The objective of this partnership is to provide long-term support to this class and to follow the progress of the students up to the 3rd grade.

To read the press release

More information on Espérance Banlieues

Since 2022, NewAlpha has been supporting WomenforSea. This association aims to raise awareness about the preservation of marine ecosystems through the production and distribution of videos produced and certified by nautical experts. The WomenforSea association highlights committed women from different sectors of activity (marine biology, responsible yachting expertise or the art of navigation), who act for the ecological and social transition by developing innovative projects. Each project aims to inspire and give the desire to act for the protection of the sea and the coastline but also to allow the valorization and the emancipation of women in the maritime environment.

More information on WomenforSea

NewAlpha has 28 employees with an average of 15 years of professional experience. NewAlpha makes a point of hiring young talent to diversify its skills and bring a complementary and new vision to its activities.

We are particularly attentive to promoting diversity (gender, profiles and experience) and the entrepreneurial spirit among our employees.

With the support of Group La Française, NewAlpha has put in place ambitious practices with regard to recruitment, compensation, career advancement and employee life balance.

For more details, please consult our Sustainability Policy

Our employees are involved in the ESG Committee.

Led by NewAlpha’s ESG Officer, this committee is composed of the key stakeholders of our organization: the CEO, the Deputy CEO, representatives of each business line and the dedicated ESG analyst. The committee meets four times a year to set new corporate responsibility objectives for our employees, partners and investments.

We have set up a dedicated support structure: NewAlpha Capital Partners. This support structure benefits from the support of all NewAlpha employees who work together throughout the support process to help implement ESG recommendations externally.

In order to include the partners in our objective of transitioning to responsible and sustainable investment, the dialogue is adapted to the profile of the incubated companies, according to their size, their year of experience, their current performance and their long-term objectives. ESG recommendations can thus be formalized at different levels.

Raising companies’ awareness of ESG best practices as expected by our institutional clients.

NewAlpha’s responsible approach is applied in each of our business lines (Multi-Management and Venture Capital).

Convinced that the integration of ESG criteria contributes to the creation of value in the long term and to the benefit of our investor clients, our extra-financial analysis applies to all the management companies and companies in our portfolio.

Our approach is applied through several initiatives:

The United Nations’ Sustainable Development Goals are the globally accepted sustainability framework.

As an asset management company, NewAlpha is committed to participating in these goals by being a committed player in two main areas: developing the industry, innovation and infrastructure of tomorrow (#9) and combating climate change (#13).

For more details on our commitments to the SDG’s,

please refer to our Sustainability Policy

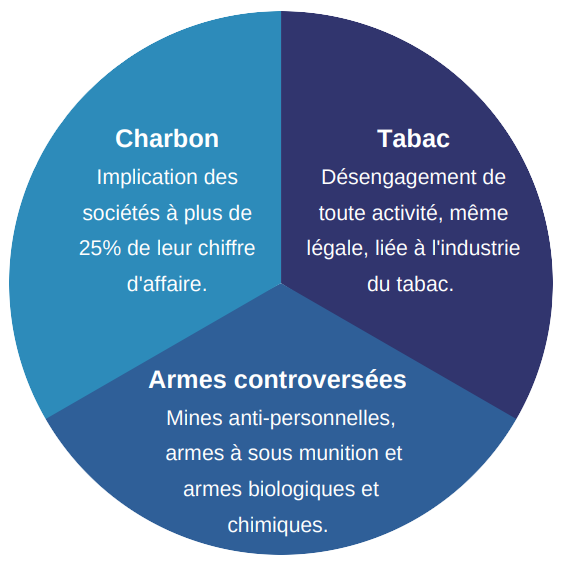

NewAlpha’s strict exclusion policy means that we do not finance activities or sectors whose practices have a negative societal and/or environmental impact. NewAlpha applies its exclusion policy to all of its investments.

NewAlpha is working towards a total disengagement from coal. The La Française Group is committed to reducing its coal exposure to zero in the following sequence: exit from coal by 2030 for EU and OECD companies and by 2040 for emerging countries.

NewAlpha has refined its ESG analysis by creating an internal rating system. This ESG analysis is carried out at two levels: on the management company and on its investment strategy. It is based in particular on ESG due diligence questionnaires, which include a specific section on climate and diversity.

The ESG analysis allows us to take stock of practices in the pre-investment phase and also to monitor and support incubated companies on areas for improvement in the post-investment phase. Detailed information on our approach can be found in our Sustainability Policy.

In 2020, the NewAlpha FinTech fund entered into a partnership with EthiFinance, an extra-financial analysis and consulting agency.

The objective of this partnership is to establish an annual report on the level of performance of the Venture Capital fund and its portfolio companies on ESG issues and an ESG support service using EthiFinance’s extra-financial services platform.

More information on EthiFinance.

Summary of our commitments as a responsible investor

Policy related to Regulation (EU) 2019/2088 of 27 November 2019 on the publication of sustainability information in the financial services sector, as amended (“SFDR”)

Compensation policy applied to all Group La Française Group

NewAlpha Asset Management’s policy on the application of voting rights