FRENCH EARLY STAGE SUSTAINABLE FINTECHS : 2024 MAPPING

Paris, March 6, 2024

NEWALPHA ASSET MANAGEMENT ADDRESSES THE 7th EDITION OF ITS ANNUAL EARLY STAGE FRENCH FINTECH MAPPING TO ENVIRONMENTAL AND SOCIAL SUSTAINABILITY ISSUES

« Together, we can act for an innovative and sustainable economy by accompanying the evolution and decisive action of financial industry players. France’s early-stage Sustainable Fintechs are at the heart of this transformation, ready to shape a more sustainable and fair financial future. We are delighted to share this latest edition of our annual mapping and to continue supporting the innovation that is improving our common future. France’s Fin&Tech scene is more promising than ever », observes Lior Derhy, Managing Partner at NewAlpha AM.

New Alpha Asset Management, a pioneer in Venture Capital Fintech in France, publishes the 7th edition of its annual Mapping of early-stage French Fintechs, highlighting Sustainable Fintechs for the first time.

WHY THIS EVOLUTION ?

The financial industry, and by extension our entire economic fabric, is rapidly evolving towards more sustainable and responsible practices. This edition reflects this crucial transition in response to current societal and environmental challenges.

SUSTAINABLE FINTECH?

According to New Alpha Asset Management’s approach, Sustainable Fintechs are unlisted entrepreneurial companies that use technologies applied to the financial industry to catalyze action in favor of economic ethics, environmental sustainability and social responsibility, without compromising medium-term profitability.

The importance of combining the two angles of Fintech and Sustainability lies in our conviction that innovation is a driver of positive change in a highly favorable context :

- Strong regulatory momentum in favor of sustainability issues.

- Positive pressure from consumers and investors, who are making sustainability issues a determining factor in their decisions.

- Pivotal role played by the financial industry, whose economic weight and potential influence steer financial flows towards responsible, ethical and sustainable initiatives in financial practices.

Implementing sustainable practices in the short term requires the adoption of new technological tools and innovative approaches. This fosters the sustained entrepreneurial emulation seen in France and Europe for Sustainable Fintech.

STRONG ENTREPRENEURIAL MOMENTUM

According to numerous recently published studies, Sustainable Fintech is one of the main Mega Trends in France and Europe. According to an E&Y study published in February 2024, France is the 3rd largest European market in this field, behind the UK and Germany.

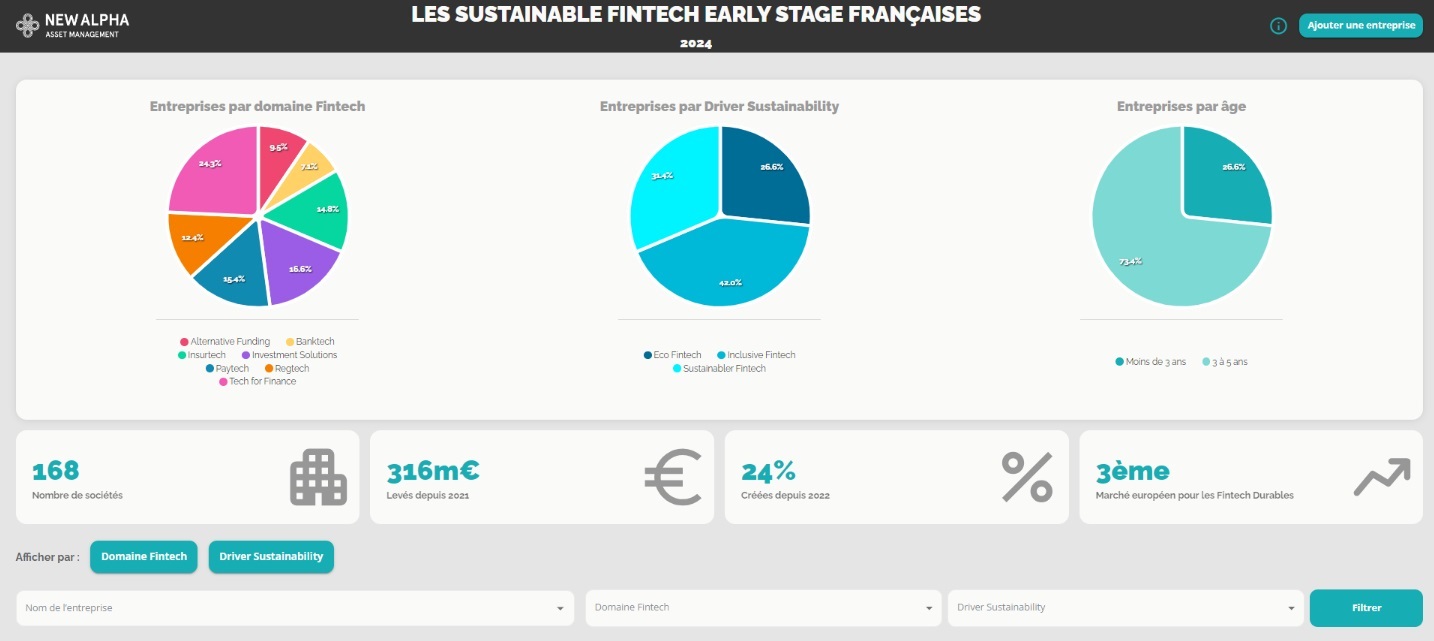

Our proprietary analysis of the French Early Stage market to the end of 20231 confirms this trend :

- A fast-growing sector in France :

- 168 Sustainable Fintechs in France by the end of 2023

- France is Europe’s 3rd largest market2

- 24% of companies were founded less than 2 years ago

- Significant fundraising :

- 316 m€ raised since 2021 through 68 transactions, 89% of which raised less than 15 m€.

- Sustainable Fintechs play a significant role in the French Fintech dynamic :

- 1/3 of Fintech operations in 2023 (1/4 in 2022)

- 1/3 of amounts raised by fintechs in 2023 (14% in 2022)

A NEW FORMAT FOR OUR MAPPING TO ILLUSTRATE THE COMBINATION OF FINTECH AND SUSTAINABILITY ISSUES

As part of this edition, New Alpha Asset Management is making available to the public a new visualization tool for its cartography on www.mapping-fintech.com, offering a dynamic view of the emerging ecosystem.

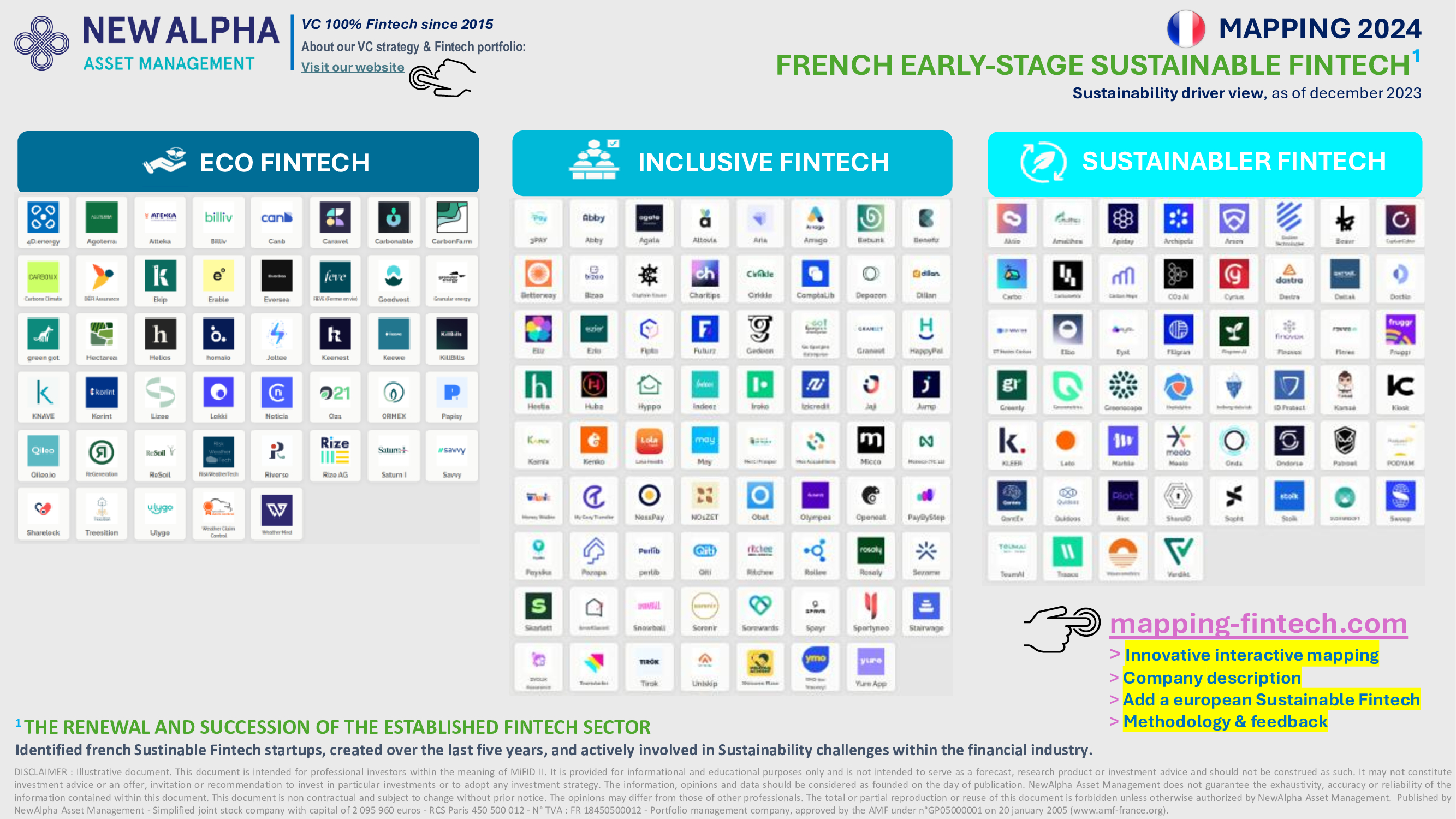

The aim of this tool, created with INVYO’s technological support, is to identify and track the development of French Sustainable Fintechs, both entrepreneurial and early-stage (5 years maximum), by cross-referencing our 7 usual Fintech domains and the 3 “Sustainability” drivers that we established following an in-depth study of the market :

- Eco-Fintech, promoting environmental transition

- Inclusive Fintech, in favour of societal transition

- Sustain-abler, in favor of the technological transition required by sustainability issues

METHODOLOGY AND SOURCES

Assignments to a Fintech domain or a Sustainability driver have been made on the basis of information made public by the companies concerned at the time of our publication3. The same applies to the descriptive elements of each company, which can be consulted on our mapping : positioning, specializations, year of creation, website. Entrepreneurs can request4 their inclusion in the Mapping, if they meet the required criteria directly, on the platform provided.

Last but not least, the Mapping is completed by an analysis of fund-raising by Sustainable Fintech1 over the last 3 years (2021 to 2023), which helps to anticipate the next operational effects expected on the market.

1. Indicative data, at the end of December 2023, based on the definition of Sustainable Fintech Early Stage proposed by New Alpha Asset Management and on public data.

2. E&Y European ESG Fintech Landscaping, February 2024.

3. Indicative analysis of companies based in particular on the degree of commitment expressed on websites/communications, on the networks to which they belong and the various labels/certifications obtained. More in-depth due diligence is required to assess each company’s actual contribution to sustainability issues.

4. NewAlpha will assess to the best of its ability the characteristics invoked with regard to the methodology selected.

For any question, feedback or possible addition in the next editions :

ABOUT NEWALPHA ASSET MANAGEMENT

Founded in 2004 and based in Paris, NewAlpha Asset Management is an asset management company specializing in the sourcing, selection and management of alternative investments. It manages over €3 billion in absolute return, private equity and venture capital funds. Its clients include over 40 French and international financial industry institutions: public and private pension funds, insurance companies, asset managers and banks. Its entrepreneurial DNA is reflected in its shareholding structure, which brings together its employees and major financial institutions (Groupe La Française – a subsidiary of Crédit Mutuel Nord Europe, AEMA and Natixis).

New Alpha AM, an independent pioneer in investing in financial industry players, has been offering professional investors the opportunity to benefit from the growth and strategic innovation of the European Fintech sector through its Venture Capital funds since 2015. In November 2015, it launched the first French Venture Capital fund entirely dedicated to Fintech startups. The investment strategy focuses on early-stage European fintechs in their inflection and acceleration phases. The management team, which has been working exclusively in this sector for over 7 years, takes minority stakes in fintech startups that are innovative in terms of their technology or business model. The team is generally involved in the first or second round of institutional financing (Seed and Series A).

Our expertise and specializations have enabled us to build what is already one of the largest fintech portfolios in France, and to benefit from a recognized positioning within the European fintech ecosystem. We have already made over 22 fintech investments since 2016, including Lydia, Digital Insure, Mobeewave, Inqom, GarantMe, SESAMm and Lizy. 6 of our investments have been made outside France (27%). We have worked with leading venture capital funds and major industry institutions.

Find out more about our VC Fintech strategy and our investments :

DISCLAIMER

INFORMATION FOR PROFESSIONAL INVESTORS WITHIN THE MEANING OF THE MIF II DIRECTIVE. The information contained in this document is provided for information purposes only and does not constitute an offer or solicitation to invest, nor does it constitute investment advice or a recommendation on specific investments. The information, opinions and figures contained herein are believed to be correct as of the date they were prepared. NewAlpha Asset Management does not guarantee the completeness, accuracy or reliability of the information contained in this document. It has no contractual value, is subject to change and may differ from the opinions of other professionals. No part of this document may be reproduced or reused without the prior written consent of NewAlpha Asset Management. Published by NewAlpha Asset Management – Société par actions simplifiée with share capital of €2,095,960 – RCS Paris 450 500 012 – VAT no.: FR 18450500012 – Portfolio management company approved by the AMF under no. GP05000001 dated January 20, 2005 (www.amf-france.org).